Kenya’s shilling and Zambia’s kwacha are expected to fall in the next week to Thursday, while the Ugandan shilling could strengthen, Ghana’s cedi will probably be steady and Nigeria’s naira may be mixed, traders said.

On December 12, during Impendence Day celebrations in Nairobi President William Ruto sought to assure worried Kenyans that the local currency that has been in-play for the past one year would stabilise mid this month in tandem with the economy that has also been hemorrhaging.

Reports of a fresh round of the shilling losing ground to the US dollar and other hard currencies is expected to unsettle importers and consumers in general as it is likely to trigger an upward movement of process of staples.

Kenya

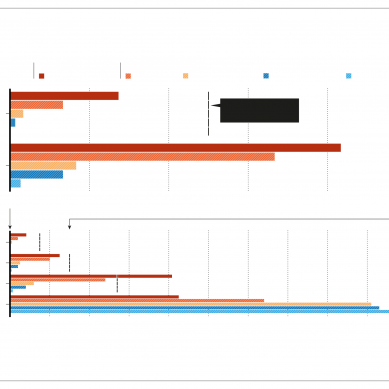

Kenya’s shilling is seen slipping on increased foreign-currency demand from the manufacturing sector and as Kenyans living abroad ask for higher exchange rates to part with their dollars. Commercial banks quoted the shilling at 153.30/50 to the US currency, compared with last Thursday’s close of 153.20/40.

On Thursday, the shilling hit a new all-time low of 153.50/70 before recouping some losses, LSEG data showed.

“Those looking to sell, especially diaspora (remittance) inflows, are looking to sell at higher (exchange) rates. I see heavy (dollar) demand from manufacturing,” one trader said.

Nigeria

Nigeria’s naira could trade around its current level on the official market, but it could strengthen on the parallel market thanks to muted dollar demand and seasonal remittance inflows.

The naira was quoted at 878 to the dollar in official trading on Thursday, compared with about 900 at the close of trading a week earlier. It was quoted at 1,225 to the dollar on the parallel market, versus 1,175 per dollar last Thursday.

“A combination of diaspora inflows and decreased demand for dollars going into the festive holiday period will see pressure on the naira ease up, especially on the black market where it will probably strengthen,” one trader said.

Ghana

Ghana’s cedi is expected to remain relatively stable next week, as market activity slows in the lead-up to Christmas. LSEG data showed the cedi trading at 11.99 to the dollar on Thursday, compared to 11.98 at last Thursday’s close.

“The cedi has seen some stability against the dollar this week despite delays in approval and disbursement of the $600 million IMF support. We expect the relative stability to remain as market players wind down ahead of the yuletide,” said Chris Nettey, head of trading at Stanbic Bank Ghana.

Ghana is working towards a debt restructuring deal with its official creditors, which will pave the way for the next disbursement of an International Monetary Fund (IMF) support package.

Uganda

Uganda’s shilling is expected to strengthen, as dollar appetite tails off with the approaching holidays. Commercial banks quoted the shilling at 3,775/3,785 to the dollar, compared with last Thursday’s closing rate of 3,768/3,778.

“In the run-up to Christmas we normally see (dollar) demand come down significantly as some businesses start to wind down activity,” one trader said, adding the shilling was likely to trade in a range of 3,750-3,770 to the dollar in the coming week.

Zambia

Zambia’s kwacha is likely to remain under pressure as hard-currency demand from importers like energy firms continues to outpace supply. On Thursday the currency was trading at 24.55 per dollar from 24.25 at the close of business a week ago.

“The local unit is expected to continue facing headwinds,” Zambia National Commercial Bank said in a note.

- A Reuters report