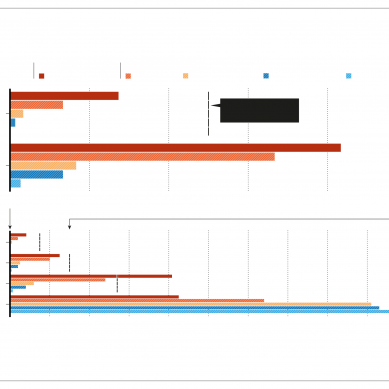

According to International Renewable Energy Agency (IRENA) data from 2020, Middle East produces less than four per cent of its electricity from renewable sources, compared to a figure of 28 per cent worldwide.

In the short term, the data by IRENA shows, the region’s nations are looking mainly to solar energy, wind and hydropower to meet climate targets, says Maroto-Valer.

Renewable technologies and nuclear power accounts for 13 per cent of Abu Dhabi’s energy mix in 2021 and are expected to reach more than 54 per cent by 2025, says Awaidha Al Marar, chair of the Abu Dhabi Department of Energy.

Egypt already hosts one of the world’s largest solar plants, at 1,650 megawatts, and Qatar plans to open an 800-megawatt solar site by the end of the year.

High levels of solar radiation give the Gulf states a natural advantage, and the cost of electricity from renewables in the Middle East has dropped to as low as 1 US cent per kilowatt hour (compared with a world average in 2021 of around 5 cents for solar projects and 3 cents for onshore wind). This is a “tremendously competitive price”, says Francesco La Camera, director-general of IRENA.

Saudi Arabia and the UAE are counting on that low cost to advance another industry – green hydrogen, a fuel made by using renewable electricity to split water into hydrogen and oxygen. Saudi Arabia has the bold aim of becoming the world’s leading producer and exporter of hydrogen in the 2030s.

It plans to achieve this through a plant under construction at a futuristic zero-carbon city called Neom, which is being built in the northwest of the country.

In the longer term, Middle Eastern nations are eyeing ways to capture carbon – whether directly from hydrocarbon plants or from the atmosphere by boosting the size of ecosystems.

The Middle East Green Initiative, for example, includes a goal of planting 50 billion trees re – reportedly the world’s biggest afforestation project, which would restore an area equivalent to 200 million hectares of degraded land and fight desertification.

Duarte says that, historically, some 38 per cent of global carbon production has been caused by habitat loss. Reversing that should account for around one-third of climate solutions, he says.

Both Saudi Arabia and the UAE will also rely on offsetting emissions directly, by capturing carbon and storing it or using it to make materials such as plastics and cosmetics. But not everyone thinks this approach is sound.

The UAE’s 2050 energy strategy, for example, includes providing 12 per cent of energy through ‘clean coal’, whose emissions are captured. Moisio calls this a “red flag”, because the technology is expensive and has not been proved to be economically viable.

In general, it should be reserved for industries that are particularly difficult to decarbonise, such as cement and steel, she says.

The elephant in the room is that the Middle East’s countries are also continuing to invest in oil and gas exploration. As is the case for most nations, exported emissions are not considered as part of net-zero targets. Middle Eastern economies are less reliant on oil than they were a decade ago.

According to World Bank figures, income from oil (specifically a metric called oil rents) accounted for 22.1 per cent of gross domestic product (GDP) in the Middle East and North Africa in 2010. By 2020, this value had fallen to 11.7 per cent of GDP – still considerably higher than the world average, which is less than 1 per cent.

That said, Russia’s invasion of Ukraine, and the subsequent sanctions that have been imposed on Russia by Western countries, have also led energy prices to soar. Saudi Arabia’s state-owned oil firm, Aramco, posted record earnings of $48.4 billion in the second quarter of 2022 – a 90 per cent increase over the same period in 2021.

Western nations have been urging members of the Organization of the Petroleum Exporting Countries (OPEC) to supply more oil, to replace Russian production. OPEC producers did agree to a modest increase, but at the most recent meeting of OPEC members and a few associated nations (including Russia), at the beginning of October, that decision was controversially reversed.

As a result of the restrictions on oil supply, prices have increased, worsening tensions between Saudi Arabia and the United States ahead of COP27.

At COP26 in Glasgow, reports suggested that Saudi Arabia was among those countries that had watered down a recommendation on phasing out fossil-fuel subsidies.

“So, I would say there is still push back, and I would say it’s understandable given that their economy is still so dependent on hydrocarbons,” says Moisio. But publicly there has been a clear shift and they don’t want to be seen as “climate-change laggards”, she says.

Stopping further fossil-fuel exploration would be “an important signal, but we haven’t seen that yet”, she adds. The International Energy Agency’s pathway towards net zero by 2050, which will need to be followed if global warming is to be limited to 1.5 ºC – includes no new investment in oil and gas production.

However, Maroto-Valer says that fossil fuels will still be needed for some time in countries that lack the infrastructure required to produce renewable forms of energy, and a fair transition process includes not penalizing nations that export to such countries. “I think we should be aiming to reduce [oil exports], but it should not only be the responsibility of the country producing it,” she adds.

Duarte recognises that Saudi Arabia’s environmental strategy was previously inadequate.

“There’s a lot of room to catch up with other nations, but the pace of progress is very steady and the strategy is very sound,” he says.

Projects to address other environmental concerns in the region, such as the conservation of coral reefs, are now backed by billions of dollars of investment, he adds. “I hope the rest of the world can eventually see what I see, and have my optimism.”

- A Nature report