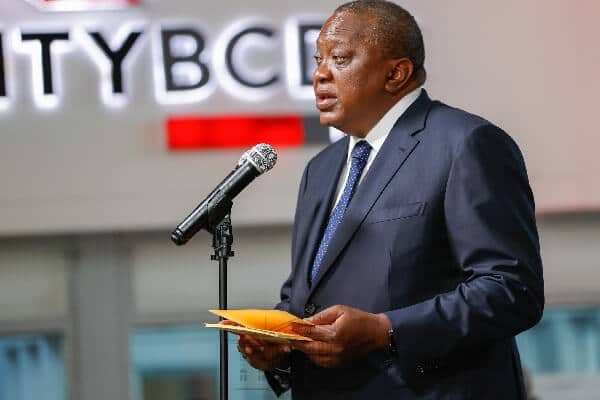

President of Kenya Uhuru Kenyatta on Wednesday commissioned the new Equity-BCDC in the Democratic Republic of Congo (DRC), a subsidiary of Kenya’s Equity Group Holdings Plc.

President Kenyatta also toured the bank’s headquarters at the towering 18-floor Equity Centre in Kinshasa, which will also serve as the head office for the Central Africa region. Equity Bank plans to expand coverage of the region in its next phase of regional growth.

Speaking during the commissioning, President Kenyatta hailed Equity Bank milestone of its successful acquisition, integration and merger to create Equity-BCDC that makes the bank the second-largest commercial bank in the DRC.

The merged entity, Equity-BCDC, has a balance sheet in excess of $3 billion and a nationwide footprint of 74 branches, 214 ATMs, 13 local dedicated desks, 3,055 agents, a staff complement of 1,156 and a customer base of over one million.

With the merger, Equity Group successfully combined BCDC’s heritage of 112 years in the DRC market, with its established track record in corporate banking, together with Equity Bank Congo’s solidly strong focus on financial inclusion.

President Kenyatta urged private investors to optimise opportunities made available by regional cooperation frameworks such as the Africa Continental Free Trade Area (AfCFTA) to create regional supply chains, observing that the effect of the Covid-19 pandemic had created a paradigm shift in global supply chains such as health, agriculture and manufacturing.

The president commended regional financial networks such as Equity Group Holdings for playing an important role in the success of regional cooperation by providing a seamless financial services intermediation across different markets.

The African Continental Free Trade Area (AfCFTA) aims to, among other goals, create a single market, deepen the economic integration of the continent, aid in the movement of capital and people, facilitating investment, achieve sustainable and inclusive social-economic development, and to encourage industrial development through diversifications and regional value chains, agricultural development and food security.

In his address, Equity Group Managing Director and CEO of Equity Group Holdings James Mwangi said, “With its size, footprint, experience, aspiration and ambition, Equity-BCDC has the distinctive capacity and unique capability to significantly contribute to positive transformation in the lives of the people of the DRC.

Mr Mwangi added that large corporate clients will particularly benefit from local credit facilities, estimated to be over $40 million on a Single Obligor Limit.

“By leveraging Equity Group’s balance sheet, lending capacity on a Single Obligor basis can be set as high as $350 million, allowing Equity-BCDC to make a real contribution to turn-key structural projects and the economy of DRC. As a subsidiary of Equity Group Holdings, Equity-BCDC will add to the Groups’ capability to play a key role in regional economic development by facilitating cross border trade especially through trade finance and payments,” Dr Mwangi pointed out.

According to Equity-BCDC Managing Director Celestin Mukeba, the merger gives over one million clients unrivalled access to a deep and wide franchise of banking expertise, channels and products, thus making it the largest existing financial services network in the DRC. We are building DRC’s first fully digital bank.

“Clients will benefit from Equity’s leading market position in the card payments sector (both credit and debit), first-in-class mobile banking applications, real-time internet banking and the full integration of bank accounts with the leading mobile wallets available in DRC and abroad,” said Mukeba.

The managing director said that Equity-BCDC has the capabilities to contribute significantly to the integration of The Democratic Republic of Congo into the East Africa region in terms of flow of capital and facilitation of regional trade.

“The bank’s business model will champion financial inclusion in DRC by empowering citizens to play an active role in the economic transformation of the country with a special focus on the corporate sector and its value chains which constitutes of the Micro, Small and Medium Enterprises (MSMEs), agriculture, artisan mining and social impact investments in education, and health,” he added.

Equity-BCDC will replicate the bank group’s business model of ‘democratising’ access to banking services and leapfrog on technology-led digitization to bring affordability and convenience into the banking industry in the country.

With its advanced banking security systems, the bank will enhance the ranking and rating of the financial system in the DRC making the country a competitive investment destination and a global economic player.

“The quality of Equity Group shareholding structures with global partners like International Finance Corporation and European Investment Bank strengthens Equity’s place as an international bank, enabling us to offer the best to our clients,” said Dr Mwangi.

- A Tell report