Kenya has just taken a calculated risk that paying more than 10 per cent on a new international bond is worth it to avoid a default later in the year, even though history is littered with examples of this kind of gamble ending in tears.

While interest rates have shot up everywhere over the last couple of years, a double-digit borrowing cost remains one of the most obvious warning signs that not all is well in a country.

Kenya’s hand was forced to a large degree, as it was facing the possibility that it wouldn’t be able to cover a $2 billion bond payment looming in June.

It took a punt, when capital markets suddenly reopened for frontier markets this year, to buy back most of that bond and issue a new $1.5 billion note that it doesn’t need to worry about until 2029, when repayments start.

Kenya’s swerving of default was greeted with relief, despite the high price – a 10.375 per cent effective interest rate or yield in banking speak. That is well above the 6.875 per cent that the 2024 bond had offered.

“The priority for many of these countries is to get over the liquidity hump,” said Francesc Balcells, Chief Investment Officer for emerging market debt at FIM Partners, explaining that the effective closure of borrowing markets for the past two years had left some nations desperate.

“Issuing at 10 per cent is not a good thing… Where this is two-three years down the road? That is tomorrow’s question,” he said, referring to how investors as well as policymakers seemed to be concentrating for now on the next bond getting paid.

History doesn’t look favourably, though, on those who need to stump up these kinds of interest rates.

Six of the 15 countries that issued bonds with coupons at or above 9.5 per cent after 2008 have since defaulted, analysts at Morgan Stanley have pointed out – Venezuela, Lebanon, Mozambique, Suriname, Ukraine, Ghana and Ecuador.

“A 40 per cent default outcome for countries having issued bonds above 9.5 per cent doesn’t bode well,” the bank’s analysts said, adding that Angola, Nigeria and El Salvador could sell 10 per cent-yielding bonds this year and perhaps even Egypt, Argentina and Ecuador.

The potential rise of a new 10 per cent club owes much to the broad-based rise in debt levels and interest rates.

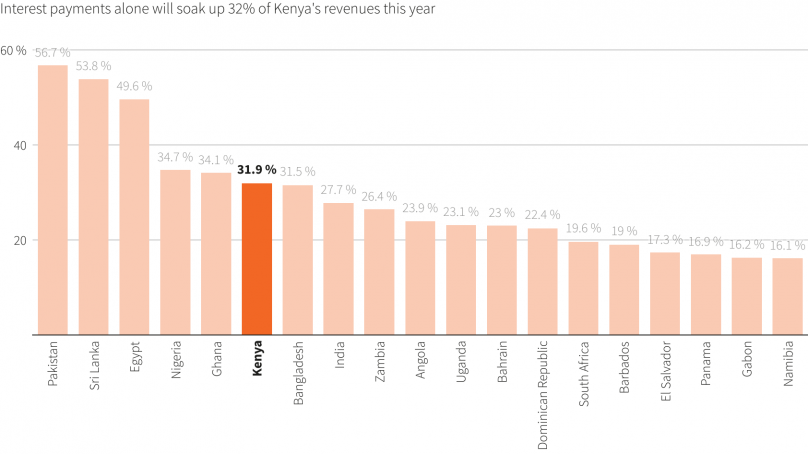

A borrowing-fuelled infrastructure drive is partly why Kenya’s debt-to-GDP ratio now tops 70 per cent. Credit ratings agency Fitch estimates it will spend almost a third of its government revenues just on interest payments this year.

For Nigeria it will be even higher, at nearly 35 per cent, while South Africa, Angola and Uganda are using between 20 per cent and 26 per cent of their revenues.

Tim Jones, head of policy at campaign group Debt Justice, said the rising costs will be a constant drain on resources that could otherwise be spent on reducing poverty and combating climate change.

“They are also laying the groundwork for even worse debt crises in the future,” he warned.

A more-than 10 per cent yield doesn’t always end in crisis, as long as a country has a fiscal repair plan and external support. Kenya benefits from international backing, including from the IMF, which boosted its support programme by $941 million in January.

Bolstering currency reserves is another vital issue.

Kenya’s were at just over $7 billion, central bank data showed last week, which doesn’t cover the statutory four months of essential imports. Its bond switch means another $2 billion isn’t about to be used up in June, though.

“It immediately removes the uncertainty of the looming maturity, boosts investor confidence, changes the dollar psychology of local market participants, while also preserving the country’s external buffers,” Jefferies strategist Thato Mosadi said.

The shilling currency has also strengthened in recent weeks, after setting record lows on an almost daily basis since late 2021.

PineBridge Investments’ Joseph Cuthbertson said dealing with the 2024 international bond could also encourage foreign investors back to Kenya’s local debt markets, where 10-year bonds offer an even juicier yield of 17 per cent.

- A Reuters report