Portuguese-speaking African countries will receive $490.2 million for the Lusophone Compact Guarantee Programme (LCGP or the Compact) to boost business development initiatives in African Development Bank’s non-sovereign portfolio.

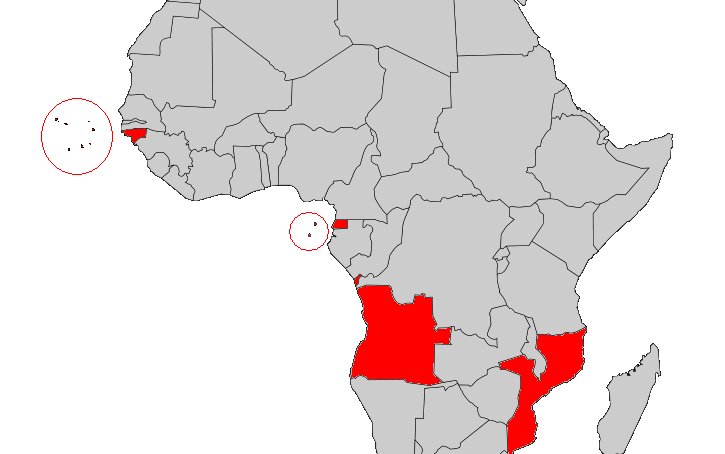

The programme, which consists of former Portuguese colonies in Africa is designed for new non-sovereign operations (NSOs) in Lusophone countries of Africa. The Lusophone bloc is made up of Angola, Cape Verde, Equatorial Guinea, Guinea-Bissau, Mozambique and São Tomé and Príncipe. The group’s acronym is PALOP.

The compact programme is structured to enable ADB to manage its risk capital between 2021 and 2025, while at the same time diversifying and growing its NSO portfolio over the medium to long-term.

The bank has invested in the development of specialised risk-sharing vehicles, initiatives and programmes that can facilitate the use of risk transfer on specific types of portfolios or assets.

The programme is expected to increase the number of private sector and Public Private Partnership (PPP) projects in PALOP as well as trade between member countries.

“Over the past five years, ADB has been committed to exploring ways and means to increase its lending capacity while proactively managing its credit exposures and headroom more efficiently, and mobilizing additional financial resources and investors to the continent’s development,” Bank Vice President for Corporate Services, Mateus Magala, said.

As the anchor member of the Lusophone Compact, Portugal would act as the guarantor of this programme, for exclusive use by the bank. The LCGP would allow for individual bank projects to be covered for up to the full maturity of the loan (up to 15 years) and up to a maximum of 85 per cent of the total bank loan principal amount, in accordance with pre-determined eligibility criteria.

The guarantee forms a very important pillar of the wider Lusophone Compact aimed at promoting and enhancing the use of financing, risk mitigation and technical assistance instruments to unlock private sector financing.

The Lusophone compact initiative is structured on a five-year general memorandum of understanding that was signed by ADB, Portugal government and PALOP member-countries to attract and unlock private sector investment and trade. The initiative became effective in December 2018.

PALOP remain the least economically integrated economic and political bloc within their respective geographical regions in Africa and despite their deep shared history, even among themselves.

This new guarantee compact is regarded as a valuable tool that will serve as an additional instrument to intensify ADB’s efforts in the financing of critical transformative NSOs in the African Lusophone countries.

The programme complements other initiatives to support member-countries to strengthen their investment climates, increase investments and to facilitate pipeline development.

“Given the adverse impacts that the Covid-19 pandemic has had on the African continent and the need to build resilience as fiscal pressures rise, the private sector plays a critical role in the process of economic recovery. Initiatives such as the LCGP will play a strategic role in equipping the bank through a programmatic guarantee to avail headroom to contribute to boosting economic resurgence in these countries,” ADB director of syndication, co-financing and client Solutions Samuel Mugoya explained.

– A Tell report