In a sweeping crackdown on financial mismanagement, the Ministry of Cooperatives and Micro, Small, and Medium Enterprises (MSMEs) has officially handed over a forensic audit report on the Kenya Union of Savings and Credit Co-operatives (KUSSCO) to national security agencies.

The report, compiled by PricewaterhouseCoopers, reveals gross mismanagement, financial irregularities, and possible criminal activities in the giant cooperative body.

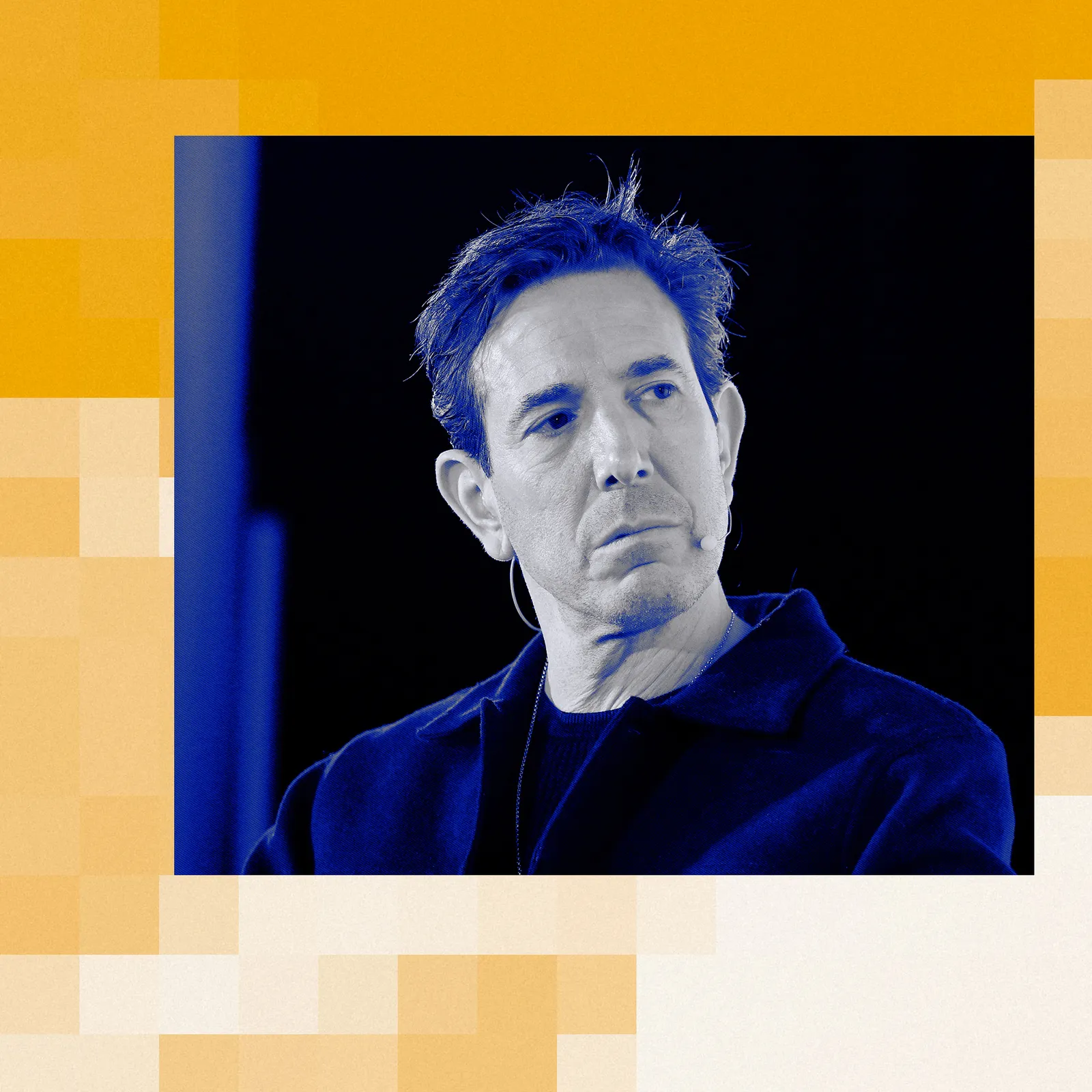

Speaking at a press conference accompanied by high-ranking officials from the Ministry, KUSCCO and the regulatory body SASRA, Cabinet Secretary (CS) for MSMEs Development Wycliffe Oparanya announced that the Inspector General of Police (IGP) Douglas Kanja, who was present at the press conference, and his team would commence investigations immediately.

According to Oparanya, the forensic audit highlighted non-performing loans totalling Ksh3.7 billion ($28.9 million), overstated profits of nearly Ksh798 million ($6.2 million) over the past six years, irregular commissions amounting to Ksh2.7 billion ($20.9 million) and mismanagement of the central finance fund to the tune of Ksh1.3 billion ($10.1 million)

“KUSCCO was established in 1973 as the umbrella body for SACCOs across Kenya, but the management veered from its core mandate, engaging in unsanctioned financial activities without proper regulatory oversight,” Oparanya observed, adding that this had led to operational inefficiencies, regulatory non-compliance and significant financial losses, prompting intervention from the government.

The minister said that while the government does not direct security agencies, it expects them to take appropriate legal and administrative action, including criminal investigations and potential asset recovery.

“We are optimistic that this will serve as a deterrent to other organizations engaging in similar malpractices,” he expressed.

However, despite the damning findings, the CS said KUSCCO remains operational, albeit under significant restructuring.

He said the ministry has confirmed that KUSCCO’s role would be narrowed to focus solely on advocacy and capacity building for SACCOs as all financial activities of the organization currently stand suspended until the institution regains public confidence.

“We have already advised SACCO members that the likelihood of recovering their money is slim, and they should adjust their financial statements accordingly,” he said, encouraging affected SACCOs to spread their losses over several fiscal periods, with the support of local banks in order to prevent widespread insolvency.

Further, the CS announced that the Cooperative Bill 2024 that is intended aims to tighten regulatory oversight and improve governance within the cooperative sector, has been passed by the National Assembly and awaited Senate approval.

“This bill is crucial for preventing future mismanagement in apex institutions like KUSCCO,” Oparanya said.

On his part, the IGP assured that the police will do their investigations thoroughly adding: “Anyone involved in the misappropriation of members’ funds will face the full force of the law.”

Kanja, promised formation of a specialized team within the Directorate of Criminal Investigations (DCI) to scrutinize the report. “This is just the beginning. Any institution found culpable will be held accountable,” warned the Inspector General

- A Tell / KNA report / Jesee Otieno