National Treasury Cabinet Secretary John Mbadi has assured the country that the 2026 Budget Policy Statement (BPS) will be a people-driven that will anchor resilience and secure a prosperous future for generations.

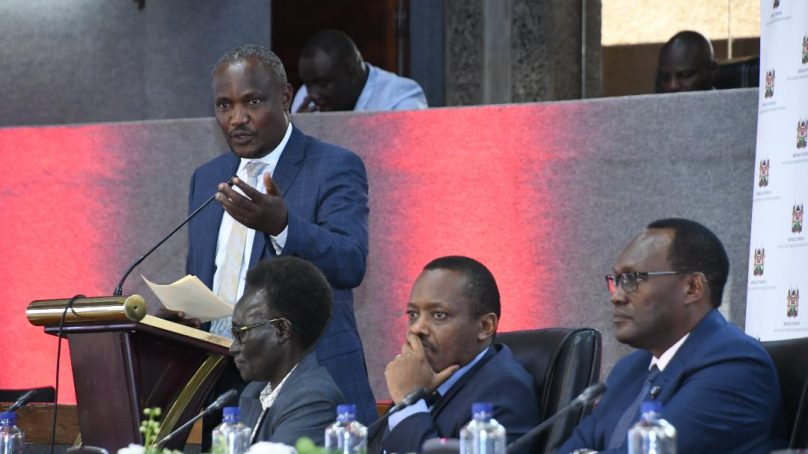

Mbadi, who exuded the confidence during the launch of 2025 Public Sector Hearings for the Financial Year 2026/2027 and the Medium-Term Budget at the Kenyatta International Convention Centre, said the hearings are intended to provide stakeholders and the general public an opportunity to give their views and influence sectoral budget proposals.

The minister said the Sector Working Groups will incorporate the input of stakeholders into the final sector reports to make them inclusive and sustainable for the future of Kenya.

“The draft proposals that will be reviewed are crafted through zero-based budgeting, a strategic approach that ensures every expenditure is justified, eliminates inefficiencies and duplications,” said Mbadi.

He said the three-day event that was attended by senior government officers, private sector and non-governmental body representatives, embodies collective commitment to shaping Kenya’s future through transparent, inclusive and responsible fiscal governance.

“This event signifies our unwavering commitment to constitutional mandates of transparency, accountability, public participation in financial governance and prudent management of public resources with utmost regard for public interest,” Mbadi said.

The national government budget-making process was initiated on August 25, 2025, with the launch of the sector working groups.

Mbadi announced that Kenya’s economy remains resilient, with projected growth rates of 4.8 per cent in 2025, which has surpassed regional averages thereby reflecting the country’s prudent economic, fiscal and monetary policy management despite the risk emanating from high public debt levels.

The cabinet secretary at the same time said the country still enjoys a stable macroeconomic environment that is supportive of growth, with all economic sectors recording positive growth rates in the first half of the year 2025 albeit with varying magnitudes.

He stated that inflation remained below mid-point of target range at 4.6 per cent in October 2025, a decline from a peak of 9.6 per cent in October last year, attributing it to positive impact of government policy of subsidising farm inputs as well as general decline in energy prices.

“Interest rates continue to decline, with 91-day Treasury Bills rate declining to 7.9 per cent in October 2025 from 15per cent a year ago,” he said.

Lending rates are also declining, leading to a growth in private sector credit of 5 per cent in September 2025 up from a contraction of 2.9 per cent in January 2025.

On exports of goods and services, the cabinet secretary disclosed that the sector continues to grow and that the official forex reserves held by the Central Bank of Kenya peaked at $11.9 billion in September this year up from $8.6 billion recorded in the same period in 2024.

“We project a growth of 4.9 per cent in 2026. This positive outlook is based on the result of deliberate policy choices, the unwavering dedication of Kenyans and a resilient service industry,” he stressed.

The cabinet secretary said the rejection of the 2024 Finance Bill spoke to the need for fiscal discipline, a reason that made the government to implement austerity measures and prioritised essential social sectors among them education, health and reinforcing the importance of prudent financial management and resource optimisation.

In containing accumulation of debt, Mbadi stated the government targets to reduce the fiscal deficit to 3 percent of Gross Domestic Product of lower over the Medium Term.

Speaking at the event, the Chai of the Budget and Appropriations Committee of the National Assembly Samuel Atandi said the view of Parliament is for the country to raise more revenue, which is currently at 14 percent to be in line with the Kenya’s Gross Domestic Product.

“Physical spaces are dwindling and are not able to raise more loans. I challenge Treasury and Kenya Revenue Authority to be bold in rising revenue,” he added.

He also called on the National Treasury to allocate resources in the budget for the confirmation of Junior Secondary School teachers as well as address the challenges in the universities and capitation.

Atandi also told the National Treasury to make adequate budget for the 2027 General Election for proper preparations so that the elections can be free, competitive and fair.

He observed that the focus of the budget should be on issues that touch on the citizens directly singling out universal healthcare, infrastructural projects, while urging those initiating development projects to focus on completing ongoing project instead of starting new ones.

National Treasury Principal Secretary Chris Kiptoo said the proposed budget for FY 2026/27 total revenue, including Appropriations-in-Aid, is projected at Ksh3,583.4 billion. This is 17.1 per cent of GDP while the overall expenditure and net lending is projected at Ksh4,649.8 billion.

“The overall expenditure will comprise recurrent expenditure of Ksh3,437.2 billion, development expenditure of Ksh761 billion and transfer to counties of Ksh446.6 billion and contingency fund of Ksh5 billion,” he stated.

- A Tell Media / KNA report by Bernadette Khaduli