Leaders from all over Africa’s payments ecosystem are in Nairobi for the inaugural Africa Edge Summit to explore how collaboration and innovation can accelerate the continent’s digital growth.

The forum focused on building the infrastructure, trust and interoperability needed to support Africa’s fast-growing digital economy, projected to gross 1.5 trillion by 2030 and create new opportunities for consumers and small businesses.

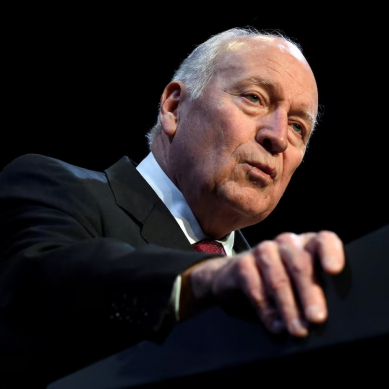

Mark Elliott, Division President for Africa, Mastercard, said Africa’s digital economy is scaling fast and Mastercard is keen to be a trusted technology partner powering the growth.

“Africa Edge is a reflection of Mastercard’s long-term commitment to the continent and supporting partners across the ecosystem to deliver secure, seamless and accessible digital experiences that help people and businesses grow,” he noted.

The event brought together senior representatives from banks, fintechs, telcos, regulators and technology firms, where Mastercard showcased two breakthrough innovations shaping the future of digital commerce.

The first-ever Agent Pay transaction in Eastern Europe, Middle East and Africa (EEMEA) region was executed live during the event, a major step toward autonomous, secure and accessible payment experiences.

Additionally, Mastercard launched the Merchant Cloud, a unified platform combining payments, AI, and security to help merchants grow confidently in an omni-channel environment.

Elliott said both innovations underline Mastercard’s commitment to building intelligent, inclusive and resilient payment ecosystems driving Africa’s digital transformation.

Speakers and panellists discussed expanding low-cost acceptance and enhancing security at scale to create a more inclusive economy. With internet penetration in Africa projected to grow by 20 per cent annually, they agreed that seamless, secure and connected payment systems are vital to sustaining growth and unlocking new opportunities for trade and entrepreneurship.

Ling Hai, President of Asia Pacific, Europe, Middle East & Africa (APEMEA) at Mastercard, emphasised that faster payments are critical to helping small businesses manage cash flow and expand.

“Africa’s digital future depends on simple, safe and accessible payment solutions that work across markets and devices,” he said, calling for stronger collaboration between public and private sectors to ensure innovation benefits all.

Futurist John Sanei, a keynote speaker, highlighted that adaptability and emotional intelligence will define leadership success in an era of AI-driven change.

To counter the rising threat of synthetic identities and deepfakes, Mastercard and Smile ID are combining AI-driven verification and liveness checks to strengthen digital on-boarding and reduce fraud across African markets.

Senior Vice President and Country Manager for East Africa and Indian Ocean Islands at Mastercard Shehryar Ali noted that East Africa has long been a global leader in mobile payments.

“We are building on that foundation by linking ecosystems like Airtel Money, MTN Momo, Mixx by Yas and M-PESA to global payment rails,” he said. “With 91 per cent of Kenyan SMEs already using digital payments, the region continues to set the pace for Africa’s $1.5 trillion digital economy opportunity.”

Discussions also underlined the growing importance of payment immediacy and liquidity, with panellists noting that same-day settlement enables small businesses to absorb shocks, reduce borrowing needs and reinvest faster.

The event concluded with a gala dinner and awards ceremony, celebrating Mastercard’s partners and customers driving innovation and inclusion in the continent’s digital economy.

- A Tell Media / KNA report / By Wangari Ndirangu